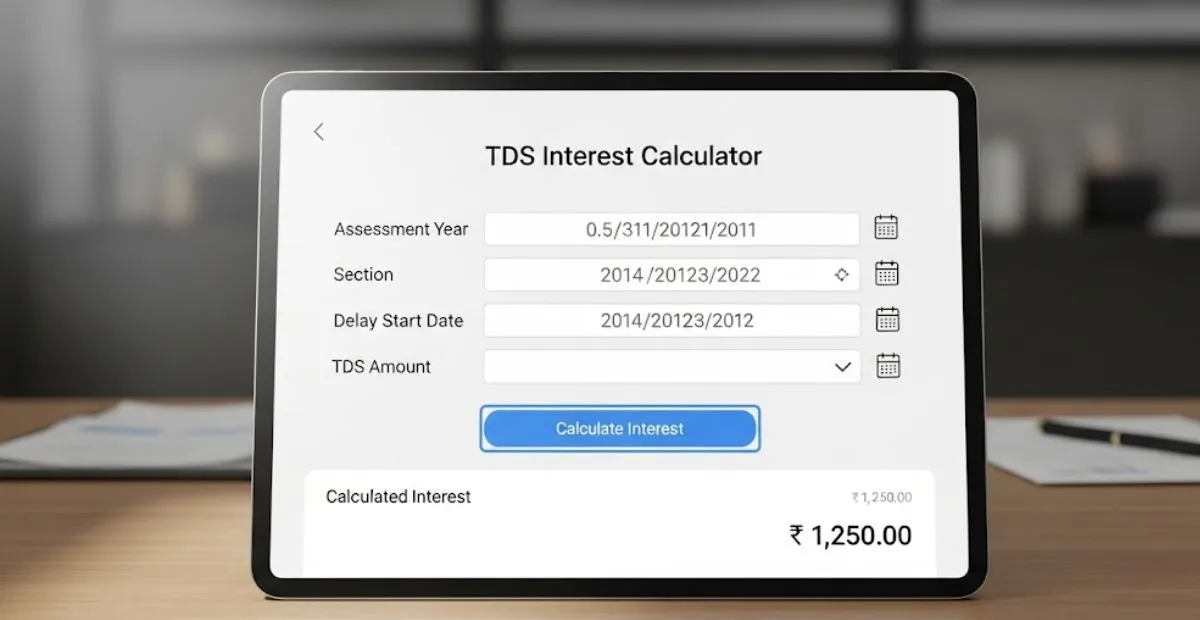

What is a TDS Interest Calculator?

The TDS Interest Calculator helps taxpayers, accountants, and businesses calculate the interest payable for late deduction or payment of TDS (Tax Deducted at Source) under Section 201A of the Income Tax Act. If TDS is deducted but not deposited, an interest of 1.5% per month is applicable. If TDS is not deducted at all, an interest of 1% per month applies until the payment date.

How to Use the Calculator?

- Enter the TDS Amount.

- Select the deduction date and payment date.

- Choose the type of default (Deducted but Not Paid / Not Deducted).

- Click on Calculate Interest to see the payable amount.

Why is TDS Interest Important?

Late payment or non-deduction of TDS can lead to penalties and interest charges. Using this calculator ensures you stay compliant and avoid unexpected financial liabilities.